The Federal Government handed down its post-election budget this week, this was Treasurer, Dr Jim Chalmer’s first budget and the first for the Labor government since winning the election in May this year. The Treasurer talked about some of the current global challenges and high inflation and laid out a plan built on “responsible, reasonable and targeted” economic management and “exercising fiscal restraint so as not to put more pressure on prices and make the Reserve Bank’s job even harder”.

The underlying Budget Deficit for 2022-23 is estimated to be $44 billion while the economy is expected to grow by 3.25%. It is expected to slow to 1.5% for 2023-24 and inflation is forecast to peak at 7.5% later in 2022.

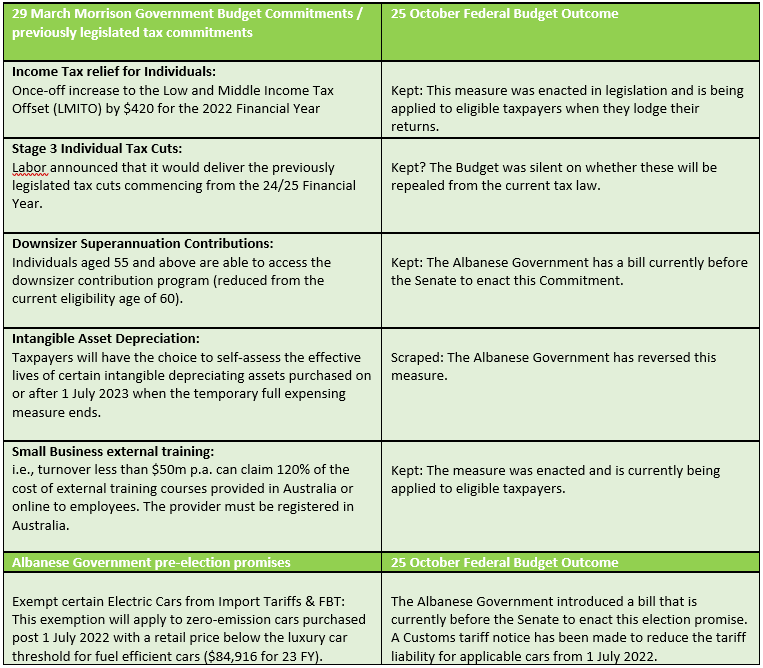

Here is a breakdown of some of the key measures from a taxation perspective.

Comparison of Morrison Government and Albanese Government Tax Changes

Personal Taxation

Digital currencies – The Government has announced that it will amend the Tax law to exclude crypto assets, such as Bitcoin, from being treated as a ‘foreign currency’ for income tax purposes. Proposed to commence from income years that include 1 July 2021.

Business Taxation

COVID-19 business grants – The Government has announced that a further 13 State and Territory COVID-19 business grants have been declared eligible for non-assessable non-exempt (NANE) treatment, which will exempt eligible businesses from paying tax on these grants. The NANE treatment applies to qualifying grants received in the 2020–21 and 2021–22 income years.

Small business supports – The Government has announced funding for initiatives to support small business owners:

• $15.1 million over two calendar years from 1 January 2023 to 31 December 2024 for the Small Business Debt Helpline and the New Access for Small Business Owners program

• $76.4 million over four years from the 2022–23 income year for outcomes from the Jobs and Skills Summit to help build a bigger, better trained and more productive workforce and boost real wages and living standards

• $3.4 million over four years from the 2022–23 income year targeting the needs of small business employers to support the implementation of the Government’s election commitment to legislate ten days of paid family and domestic violence leave.

Off-market share buy-backs – The Government announced that the Government will improve the integrity of the tax system by aligning the tax treatment of off-market share buy-backs undertaken by listed public companies with the treatment of on market share buy-backs. This measure will apply from 7:30 pm AEDT on 25 October 2022.

Multinational Tax Integrity Package – The Government announced that it will amend Australia’s thin capitalisation rules to replace the safe harbour and worldwide gearing tests with earnings based tests to limit debt deductions in line with an entity’s profits. The changes will apply to multinational entities operating in Australia and any inward or outward investor, in line with the existing thin capitalisation regime. Financial entities will continue to be subject to the existing thin capitalisation rules. Proposed to commence from the 2023–24 income year.

Electric Car Discount – The Government has announced that it will exempt battery, hydrogen fuel cell and plug-in hybrid electric cars from FBT and import tariffs if the car:

• has a first retail price below the luxury car tax threshold for fuel-efficient cars, and

• has not been held or used before 1 July 2022.

The FBT measure is contained in the Treasury Laws Amendment (Electric Car Discount) Bill 2022 — introduced into Parliament on 27 July 2022 — which proposes to amend the FBTA Act by introducing an electric car discount in the form of an FBT exemption. This means that car fringe benefits provided by employers to employees, comprising the use or availability for use of an eligible car that has zero or low emissions will be exempt from FBT if the relevant requirements are met. Employers will need to include exempt electric car fringe benefits in an employee’s reportable fringe benefits amount. Proposed to commence from 1 July 2022.

Superannuation

Expanded eligibility for downsizer contributions – The Government has announced that it will reduce the minimum age for making a downsizer contribution from 60 to 55 years of age. The measure is contained in Schedule 5 to the Treasury Laws Amendment (2022 Measures No. 2) Bill 2022 which is currently before Parliament. The reduced age is proposed to apply to downsizer contributions made on or after the first day of the first quarter after the day of Royal Assent.

Other

Women’s Budget Statement –funding for various measures regarding women’s economic security, ending violence, and gender equality, health and wellbeing.

- Cheaper child care – The Government has announced that it will provide $4.7 billion over four years from 2022–23, and $1.7 billion per year ongoing, to deliver cheaper child care to ease the cost of living and reduce barriers to workforce participation. This is proposed to commence from the 2022–23 income year, the proposed changes include:

-

- an increase in the maximum Child Care Subsidy (CCS) rate from 85 per cent to 90 per cent for the first child in care

- increasing the CCS family income eligibility threshold to $530,000

- increasing the CCS rate for all families earning less than the threshold.

- Boosting Parental Leave – The Government has announced that it will extend and make more flexible the Paid Parental Leave (PPL) scheme. Under the proposed changes, from 1 July 2023:

- both parents will be able to share the entitlement, with a ‘use it or lose it’ portion for each parent

- parents will be able to claim the payment concurrently and take leave at the same time

- parents will be able to take leave in blocks as small as a day at a time, with periods of work in between

- a $350,000 family income test will be introduced as an alternative to the individual income test.

- The expansion of the PPL scheme to 26 weeks will be phased in from 1 July 2024 to 1 July 2026.

Our full summary of the measures and start dates can be found here: Federal Budget Summary October 2022-2023

The Federal Government Budget papers can be found here: Budget documents | Budget October 2022–23.

Should you have any questions or need any help ensuring you receive all available assistance, please reach out to our team and we will endeavour to do our best to assist.

The team at Rose Partners.