The Federal Government has handed down its pre-election budget last night, outlining its plans to boost the economy and relieve cost of living pressures. The Treasurer revealed a $78 billion deficit (3.4 per cent of GDP), down from a $79.8 billion deficit the year before.

“Over the next 3 years, this will more than halve to 1.6 per cent,” Josh Frydenberg said.

He confirmed that net debt as a share of the economy will peak at 33.1 per cent at 30 June 2026, significantly lower than forecast last year.

Here is a breakdown of some of the key measures from a taxation perspective.

Personal Taxation

The low and middle income tax offset – will be increased by an amount of $420 for individuals with earnings up to $126,000 per annum, and payable in respect of the 2021-22 income year. The Government has not announced an extension of the low and middle income offset beyond the 2021-22 income year. The maximum offset payable to an individual is $1,500 where their earnings are between $48,001 and $90,000 which then phases out up to an amount of $126,000. The low income tax offset remains unchanged and will continue to apply for the 2021-22 and 2022-23 income years. The maximum amount of the low income tax offset is $700 on an income of $37,500. The offset is phased out for individuals who earn greater than $66,667.

Covid 19 tests deductible – Costs incurred by individuals for undertaking Covid 19 tests to attend a place of work will be deductible from 1 July 2021. As such, no fringe benefits tax should be incurred by employers for providing the benefit of the test to employees.

Business Taxation

Skills and training boost – To support small businesses to train and upskill their employees, small businesses with an aggregated annual turnover of less than $50 million will be able to deduct an additional 20 per cent of expenditure incurred on eligible external training courses provided to their employees. The 20 per cent boost will be claimable in respect of eligible expenditure:

- incurred by 30 June 2022 —in the tax return for the following income year;

- incurred between 1 July 2022 and 30 June 2024 — in the income year in which the expenditure is incurred.

Technology investment boost – To support digital adoption, small businesses with an aggregated annual turnover of less than $50 million will be able to deduct an additional 20 per cent of expenditure incurred on business expenses and depreciating assets that support digital adoption, such as portable payment devices, cyber security systems or subscriptions to cloud-based services. The deduction is allowable for expenditure incurred from 7.30 29 March 2022 to 30 June 2023. An annual cap will apply in each qualifying income year so that expenditure up to $100,000 will be eligible for the boost. The 20 per cent boost will be claimable in respect of eligible expenditure incurred:

- by 30 June 2022 the boost — in the tax return for the following income year;

- between 1 July 2022 and 30 June 2023 — in the income year in which the expenditure is incurred.

PAYG/GST Instalments – The budget confirms that for small and medium business the GDP uplift factors will be limited to 2% in respect of instalments that relate to the 2022-23 income year. The two per cent GDP uplift rate — rather than the statutory 10 per cent — will apply to small to medium enterprises which have aggregated turnover of up to:

- $10 million — for GST instalments; and

- $50 million — for PAYG instalments.

Employee Share Schemes – The Government has announced that it will expand access to employee share schemes (ESS) and further reduce red tape so that employees at all levels can participate in the scheme. Participants of ESS in unlisted companies will be allowed to invest up to:

- $30,000 per participant per year, accruable for unexercised options for up to five years, plus 70 per cent of dividends and cash bonuses; or

- any amount, if it would allow them to immediately take advantage of a planned sale or listing of the company to sell their purchased interests at a profit.

Patent Box expansion – In the 2021-22 Budget, the Government announced the introduction of concessional tax treatment for eligible corporate income associated with new patents in the medical and biotechnology sectors (referred to “patent box” income). The legislation for this is now before parliament. For the 2022-23 budget the regime is proposed to expand to:

- update policy specifications for Australian medical and biotechnology innovations to allow for patents granted or issued after 11 May 2021, and various patents issued by the US and Europe, to be eligible for the regime;

- support practical, technology-focused innovations in the Australian agricultural sector;

- support commercialised patented technologies which have the potential to lower emissions.

Concessional tax treatment for primary producers generating revenue from carbon credit units and biodiversity certificates – The Government has announced that it will apply concessional tax treatment to primary producers that generate revenue from the sale of Australian Carbon Credit Units (ACCUs) and biodiversity certificates. Under the proposed tax changes:

- farmers will treat revenue from the sale of ACCUs as primary production income, providing access to income tax averaging arrangements and the Farm Management Deposit scheme;

- revenue from ACCUs will be recognised in the year of sale to support cash flow;

- biodiversity certificates will treated in the same way as ACCUs.

- Proposed to commence from 1 July 2022.

Superannuation Highlights

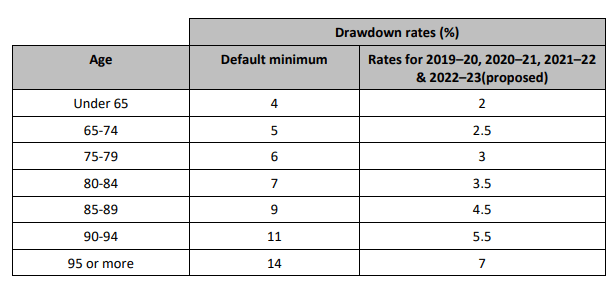

Extension of temporary reduction of minimum pension drawdown – The 50% reduction of the minimum superannuation pension drawdown requirements will be extended for the 2022-23 income year. Given the ongoing volatility in financial markets, this measure will allow retirees to avoid selling assets in order to satisfy the minimum drawdown requirements.

Our full summary of the measures and start dates can be found here: Federal-Budget-2022-23 Summary

The Federal Government Budget papers can be found here: Budget documents | Budget 2022-23.

We will provide more information once these measures have been legislated.

Should you have any questions or need any help ensuring you receive all available assistance, please reach out to our team and we will endeavour to do our best to assist.

The team at Rose Partners