The Federal budget was announced on Tuesday 6th October after a delay due to the coronavirus pandemic.

Treasurer Josh Frydenberg said it would focus heavily on job creation in order to pull the country out of the economic crisis it faces. With uncertainty remaining until a vaccine for Covid-19 is available, there will likely be more announcements as circumstances change over time.

The budget makes for compelling reading for anyone in business as it contains some very significant tax concessions and changes.

Some of the key measures in the budget are:

Tax cuts

Lower and middle-income earners will receive a tax cut that will be up to $2,745 for singles or up to $5,490 for dual-income families in 2020–21.

The table above is taken from the Government’s Budget website – talk to us about actual figures for your situation.

Businesses

Employers and young workers – From 7 October 2020 eligible employers, who are not receiving JobKeeper payments, may be able to claim $200 per week for each additional eligible employee hired for a new position aged 16 to 29 at the time of start date of their employment and $100 per week for each additional eligible employee aged 30 -35.

The key criteria are:

- The employee must have received JobSeeker, Youth Allowance or the parenting payment in one of the three months prior to employment.

- The new position must increase total employee headcount and payroll for the reporting period compared to the three months ending 30 September 2020.

- The credits are only available to employers using Single Touch Payroll (STP) and have all ATO lodgment obligations up to date.

- The new employee must work on average 20 paid hours per week for the full weeks they are employed over the reporting period.

Registration of new employees is open from 7 October 2020 to 7 October 2021. The Job Maker Hiring Scheme credit may be claimed by the eligible employer from 1 February 2021 for new jobs created for the period 7 October 2020 to 6 January 2021. The claim must be submitted within 3 months after the opening of the claims period. The credit is paid quarterly in arrears for 12 months from the date of employment.

The instant asset write-off threshold – Businesses with turnover up to $5 billion will be able to write off the full cost of eligible depreciable assets of any value from 7.30pm AEDT on 6 October 2020 and first used or installed by 30 June 2022. The cost of improvements made during this period to existing eligible depreciable assets can also be fully deducted. Businesses with an aggregated turnover of less than $10 million can deduct the balance of their simplified depreciation pool (STS pool) at the end of the income year while the full expensing applies. The provisions that prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out will continue to be suspended.

In principle, it appears that the temporary instant asset write off will allow corporate tax entities to acquire capital assets and install ready for use by 30 June 2022 to the point where the deduction places the company in a loss position. That loss can then be carried back and claimed against income tax paid in the 2019 or later income tax years.

Temporary loss carry-back – Companies with turnover up to $5 billion that incur an income tax loss in the 30 June 2020, 2021, or 2022 income tax years will be able to temporarily, up to June 2022, offset tax losses against previous profits and tax paid in or after 2018-19. The loss carryback is able to generate a refundable tax offset in the year in which the loss is made. The tax refund is limited by requiring that the amount carried back is not more than the earlier taxed profits and that the carryback does not generate a franking account deficit.

Companies that do not elect to carry back losses under this measure can still carry losses forward as normal.

Research and Development – For small claimants (turnover less than $20 million), the Government will increase the refundable R&D tax offset to 18.5 percentage points above the claimant’s company tax rate.

Fringe Benefit Tax Returns now simpler – employers will be able to use existing corporate records, rather than prescribed records, to complete their FBT return and employer-provided retraining activities will now be exempt when employees are redeployed to a different role in or outside the business. From April 2021, carparks and electronic devices will also see concessions.

No changes in the Division 7A Anti Avoidance Provisions for Private Companies – The 2018–19 Budget, announced it would further clarify the operation of Division 7A. However, on 30 June 2020, the Government announced that the start date for the previous Budget announcements will be revised. They will now apply from income years commencing on or after the date of Royal Assent of the enabling legislation. Last night’s announcements have not altered the uncertainty around Division 7A. We hope that clarification of the rules will happen at some time this year. We will keep you posted.

Victorian Government Business Support Grant classified as non- assessable, non-exempt income – The Victorian Government Business Support Grant extension (3rd tranche of the Grant) announced on 13 September 2020 will be classified as non-assessable, non-exempt (NANE) income for tax purposes. This differs from the tax treatment applicable to the first two tranches of the Victorian Government Business Support Grants. The first two tranches of the Grant continue to be considered taxable income of the recipient business.

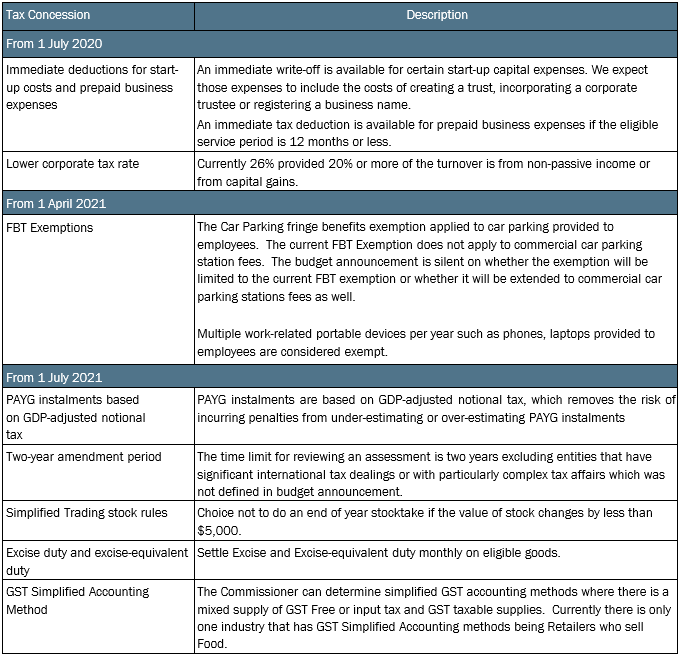

Expanding Access to Small Business Entity Tax Concessions to businesses with a turnover of between $10m and less than $50m – The following taxation concessions will now be available to business entities with a turnover of between $10m and less than $50m effective from the start dates noted in the table.

Paid parental leave is extended – Parents will now qualify for the payment if they have worked 10 of the 20 months before giving birth or adopting, as opposed to 10 of the past 13 months.

Tourism

$50 million will go to a Regional Tourism Recovery initiative to support tourism operators market to a domestic audience.

Farming

The budget promises $2 billion for concessional loans to help Farmers recover from drought. There are also plans for improved water infrastructure and support for exporters.

Infrastructure

Over the next four years, an additional 14 billion is committed for new and accelerated projects in Australia.

Apprenticeships and training

From 5 October 2020 up to 30 September 2021, businesses will receive the 50 percent wage subsidy, up to a cap of $7,000 per quarter, for commencing apprentices and trainees, including those employed by Group Training Organisations, until 30 September 2021 $252 million will be spent over two years to support the delivery of 50,000 higher education short courses in areas including teaching, health, information technology, science and agriculture.

Super

Superannuation funds will now be linked to employees and move with them in order to stop so the creation of unintended multiple accounts. An online tool named YourSuper will give people the ability to compare funds. Aged care pensions will increase by an extra $250 payment in December and March, and government funding will be provided for 23,000 new home care packages.

For those with passive investments in the Superannuation System above the $1.6 million pension cap and in the pension phase, consideration should be given to identifying where such investments should be held. You could consider accessing a portion of this accumulation balance and investing the proceeds outside of the superannuation environment. This could result in you gaining access to the reduced personal tax rates and therefore lowering your overall family tax rate.

There are also commitments across a number of other areas such as for the homeless, investment in dementia care, health, tourism, first home buyers, and the environment.

For more details on the budget download the pdf.

We will provide more information once these measures have been legislated.

Should you have any questions or need any help ensuring you receive all available assistance, please reach out to our team and we will endeavour to do our best to assist.

The team at Rose Partners